Why OnSite Credit Card Processing Is So Crucial For Your Business

Time is money, that’s a cliché almost every business owner is familiar with. One of the best ways to improve gains and minimize the loss of your business is to recognize the importance of saving time as much as you can. One of the key strategies to achieving this, is following another popular cliché, “cash is king” the sooner your customer pays for your product and services, the more profits you rake in and the more competitive your business will be. This is why onsite credit card processing is so important.

Is it a smart business decision to have your technicians’ process credit card payments on the spot rather than zoom off to the location of the next job while your customer waits for an invoice to be prepared and sent to them? The answer to that question in the past might have tilted towards visiting as many customers as possible and completing as many jobs as they can rather than spend any extra time with a customer whose job has been completed to process payment. But today with the innovative technological solutions available which make collecting and processing payments easier, more convenient and a lot more secure, onsite credit card processing is an absolute must.

Faster Cash Flow

No matter the size of your business or type of industry, Cash flow is one of the major things that differentiates a top-performing business and an average company. Let’s assume you stick to the old method of manually preparing an invoice and sending it to  your customers; the average processing and response time can take as much as four days after the job has been done especially if you are dealing with a large organization rather than an individual.

your customers; the average processing and response time can take as much as four days after the job has been done especially if you are dealing with a large organization rather than an individual.

Even when it was an individual that enlisted your services, it is common knowledge that most people generally don’t respond to invoices the same day they receive them so you should expect a lag of at least a day after whatever length of days it takes you to prepare the bill on your end.

Employing onsite mobile invoicing and onsite credit card processing helps you cut down drastically on the time it takes to process your payments. Both from your end of the transaction as well as on the part of your customers. Better cash flow is a lot healthier for your business than days of delay waiting for payments to be made.

Reduced Processing Costs

By incorporating onsite credit card processing, you cut processing costs in two different ways. First, less time is spent on processing invoices in the office and less labor is required, that way your company needs less support staff in that department thereby saving some costs. You can even look at expanding your company without having to worry about the extra load of new staff additions.

Another way onsite credit card processing help you boost sales is reducing how much is lost through bounced checks, unpaid invoices and rejected credit cards all of which might cause procurement of extra processing costs. All of these are eliminated through onsite credit card processing since payments are validated in real time.

Error reduction

On-site invoice preparation and payment processing are less prone to errors that may occur with manually processing payments. A mobile software with mobile invoicing capabilities automatically prepares bills based on labor time spent on the job and sends the invoice electronically to the customer’s email; this eliminates errors such as incorrect handling which can adversely affect profits. Introducing automation in the area of invoice preparation and processing credit card payments on-site is free from the various errors that may arise in the process of manually preparing invoice and processing payments.

Increased Revenue

Onsite credit card processing also helps to boost sales and revenue by eliminating sales errors such as unbilled services, billing disputes and credit card issues. By providing mobile payment options for your customers you are no longer limited by your  customer’s cash at hand. When this is eliminated, and your customers can make payments electronically, the limit to what they can buy from you is no longer limited by available cash. Thus boosting sales and revenue for you and higher profits in the long run. Issues and questions arising about services rendered or invoice prepared can also be answered on the spot increasing customer satisfaction and trust in your services.

customer’s cash at hand. When this is eliminated, and your customers can make payments electronically, the limit to what they can buy from you is no longer limited by available cash. Thus boosting sales and revenue for you and higher profits in the long run. Issues and questions arising about services rendered or invoice prepared can also be answered on the spot increasing customer satisfaction and trust in your services.

Interestingly the requirements for setting up onsite credit card processing isn’t at all difficult. In the past, all that was needed to set up onsite credit card processing was a card reader and a preferred gateway which helps you manage transactions between the point of sale (i.e. the mobile device) and the financial institution, such as the credit card company or bank of your customer. But today onsite credit card processing has been made a lot easier with FieldSurf. You do not need to buy a card reader device before you set up onsite credit card processing for your business. FieldSurf is an all on one tool for that.

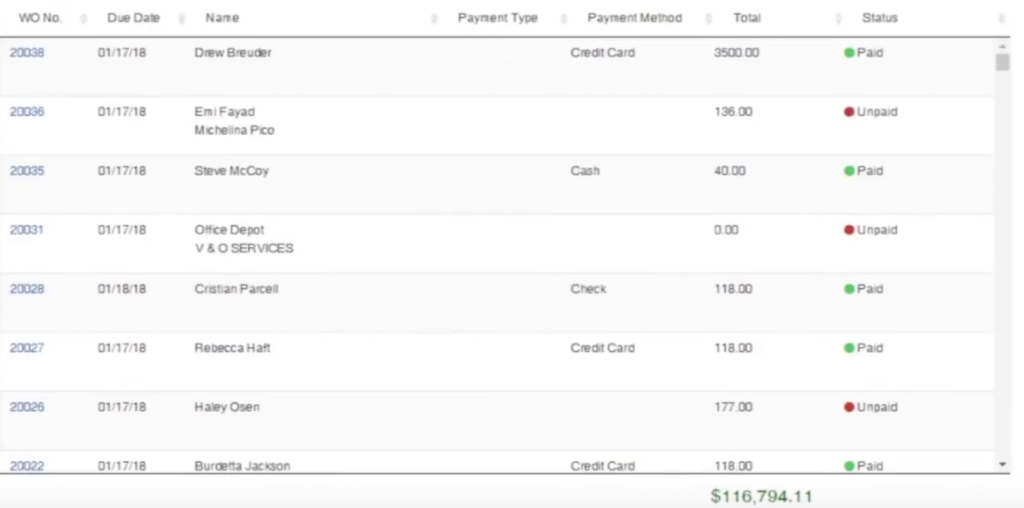

FieldSurf is a cloud-based field service management software which has features that make onsite payment processing a breeze. First it has an electronic invoicing function that automatically prepares an invoice for any work order that comes in and sends it to your customers immediately the moment they sign that the job is completed. This makes calculating your customers bill and preparing an invoice piecemeal for your technicians. Asides this unique function, you can also use FieldSurf to accept credit card payments on-site.

With FieldSurf, you can add a simple card-swiping device your technician’s mobile phone. Once a job is done and your customer receives their invoice, immediate payments can be processed by swiping the customer’s credit on the technician’s phone. Even if the credit card is not physically available, all you need is the credit card details and payments can still be made.

This is just one of the many unique features that make business easy for service companies. FieldSurf also has a lot of other unique features that you can explore and will find very useful in the daily running of your business.